- Tech Stock Insider

- Posts

- This Database Finally Broke Out Of The Server Room And Should Be In Your Portfolio

This Database Finally Broke Out Of The Server Room And Should Be In Your Portfolio

When a supposedly boring database name jumps on a clean beat-and-raise, it stops being background plumbing and starts looking like a setup.

This one just turned a choppy year into a fresh buy-the-dip opportunity for anyone willing to hold through the next data cycle.

$1K Could’ve Made $2.5M

In 1999, $1K in Nvidia’s IPO would be worth $2.5M today. Now another early-stage AI tech startup is breaking through—and it’s still early.

RAD Intel’s award-winning AI platform helps Fortune 1000 brands predict ad performance before they spend.

The company’s valuation has surged 4900% in four years* with over $50M raised.

Already trusted by a who’s-who roster of Fortune 1000 brands and leading global agencies. Recurring seven-figure partnerships in place and their Nasdaq ticker is reserved: $RADI.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Never Miss Our Top Tech Recommendations Again!

We now send our tech picks via text, too, so you’ll get the same tech breakout news without having to open your inbox.

Consumer Tech

Apple’s Vintage Purge Just Claimed New Victims

Apple (NASDAQ: AAPL) has officially moved the original iPhone SE to its Obsolete List, closing the chapter on one of its most loved budget devices.

The update arrives alongside the retirement of several 2nd-gen iPad Pros, special edition Apple Watch Series 4 models, and the Beats Pill 2.0.

The SE earned its fame by packing flagship speed into a tiny $399 frame that felt like a time capsule.

Fans who wanted power without paying premium prices found their perfect match in that compact aluminum body.

The Small Phone With a Big Attitude

The SE borrowed the classic iPhone 5 design and revived it with newer internals that made it punch above its weight.

Many people still swear it was the last perfect one-handed phone.

Its 4-inch display, Touch ID button, and chamfered frame became a comfort zone for users tired of giant screens.

The A9 chip from the iPhone 6 generation made it fast enough to hang with bigger siblings.

Obsolete Today; Collectible Tomorrow

Apple continues to cycle out older hardware as it streamlines support for its modern lineup.

Devices that once shaped an entire generation of users now slip quietly into unsupported status.

Collectors will likely treat the SE as retro gold while everyday users finally move on. For anyone still holding one, your vintage badge of honor just became official.

Autonomous Driving

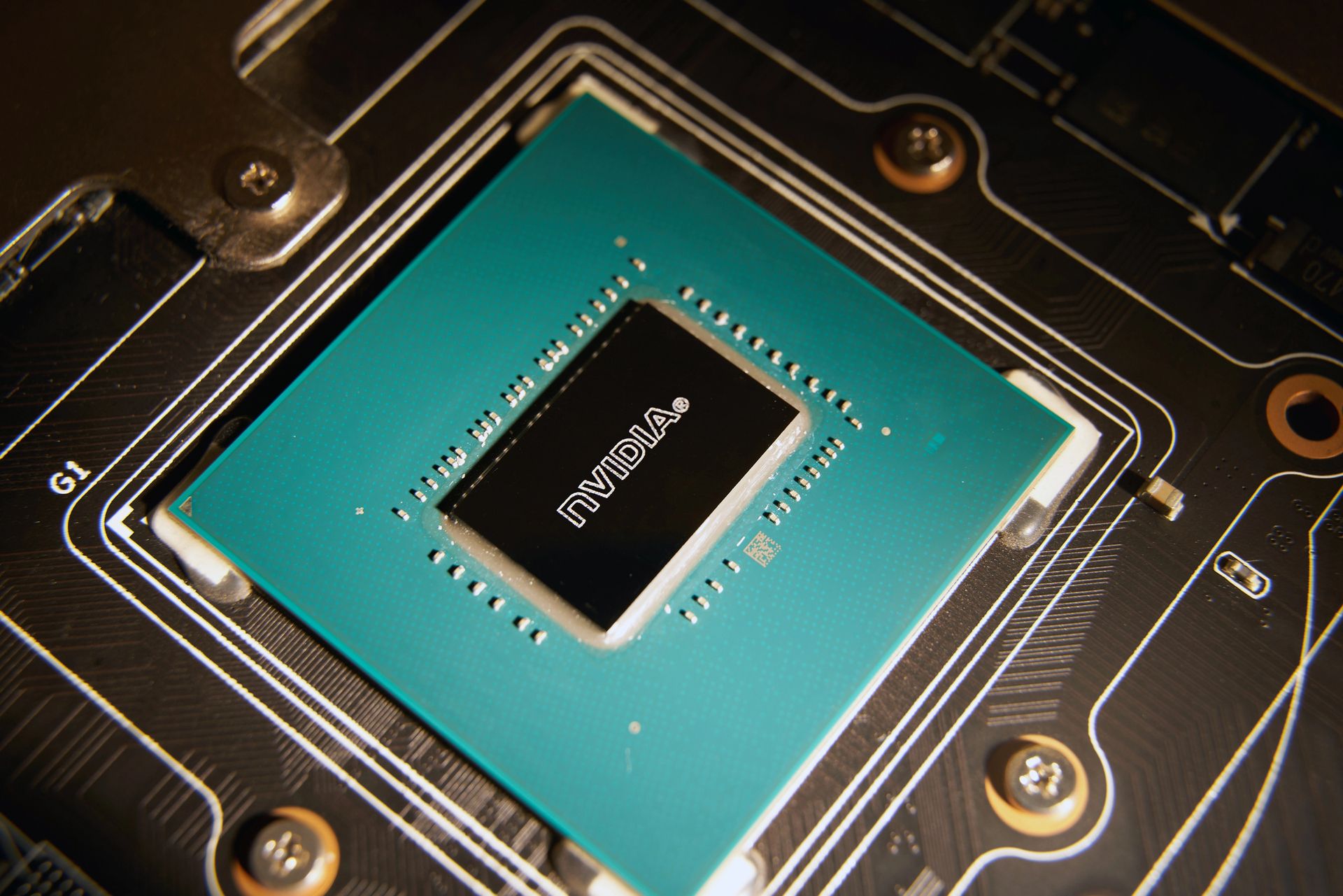

Nvidia Pushes Physical AI Into High Gear With a Model Built for the Road

Nvidia (NASDAQ: NVDA) has introduced Alpamayo R1, an open-source vision-language model designed specifically for autonomous driving research.

The system blends visual inputs with text-based logic, allowing a vehicle to interpret scenes with far more context than standard perception models.

The model is built on Nvidia’s Cosmos family, a series of AI systems designed to think through decisions step by step.

Nvidia’s goal is to help cars process the environment in a way that mirrors human intuition rather than relying on rigid rule sets.

Why Reasoning Models Matter for Level 4 Goals

Alpamayo R1 is aimed at advancing physical AI toward dependable level 4 autonomy, where vehicles operate within defined zones without driver intervention.

The model tackles the nuance gap, like judging unusual road behavior or prioritizing multiple risks at once.

Nvidia views physical AI as the next massive GPU engine, and this release shows how aggressively the company is preparing.

The stronger the reasoning abilities, the easier it becomes to train consistent driving behaviors across complex environments.

The Cosmos Cookbook Pushes Developers Further

Alongside the new model, Nvidia rolled out the Cosmos Cookbook, a set of training guides covering data pipelines, synthetic data generation, and evaluation workflows.

The combination of open access, developer tooling, and a model built for on-road reasoning pushes Nvidia deeper into the world of advanced autonomy.

The company is clearly betting that the next leap forward will come from smarter models rather than larger sensors.

See List (Sponsored)

We’re sharing a free copy of our brand-new report: 7 Best Stocks for the Next 30 Days.

For decades, our objective, mathematical stock prediction system has delivered market-beating results, identifying trades with exceptional potential.

This report uncovers the 7 highest-potential stocks from our top-rated selections — fewer than 5% of all stocks qualify.

These could be the most exciting short-term trades in your portfolio.

Act now — download your free copy and be ready for the next move.

[Get the Free Report]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Networking

The Cloud Giants Just Formed a Mega Internet Superhighway

Amazon (NASDAQ: AMZN) and Google (NASDAQ: GOOGL) have joined forces to launch a multicloud networking service that cuts weeks of deployment into minutes.

The move gives companies a private, high-speed tunnel between AWS and Google Cloud.

The timing could not be better, following the October AWS outage that froze apps like Snapchat and Reddit.

Analysts say that the event cost US businesses up to $650 million, proving how fragile the modern internet can be.

Your Data Now Travels Like a VIP

The new service blends AWS Interconnect with Google’s Cross-Cloud Interconnect to boost reliability for apps that run across both ecosystems.

Companies running hybrid stacks can finally migrate data without fear of traffic jams.

Enterprise teams get a setup that feels more like plugging in a cable than architecting a maze.

Developers also gain a smoother path to shift workloads between clouds with fewer hops and fewer fire drills.

Multicloud Just Became Mainstream

Salesforce is already using the setup, a sign that big customers are ready for cleaner cross-cloud highways. The system is built for firms that depend on nonstop connectivity.

AWS remains the world’s largest cloud provider, but its rivals are catching fire fast.

This partnership signals a future in which cloud giants compete loudly yet cooperate quietly when the stakes are high.

Poll: If your bank gave you a new perk, what would you choose? |

Recent Tech Movers

Intel (NASDAQ: INTC)

Old Guard, New Factories

Intel’s stock has quietly had a monster year, and it’s acting like a company that wants to matter in chips again.

The latest move: another roughly $200 million earmarked for assembly and testing in Malaysia, on top of a multi-billion-dollar packaging build-out already in the works.

For you, this is part of the same story: Intel trying to reinvent itself as both product designer and contract manufacturer while governments shower the industry with incentives.

Execution still has to catch up with the ambition, but every incremental investment like this reinforces the we’re serious about being a global foundry pitch.

Dips may appeal to patient investors who think the turnaround is more marathon than sprint.

Shopify (NYSE: SHOP)

Cyber Monday Panic, Five-Minute Problem

If you’re going to have login issues, maybe don’t pick Cyber Monday.

Shopify had thousands of merchants and shoppers reporting problems accessing admin and POS tools right in the middle of the rush, with outages peaking late morning before the company rolled out a fix and saw logins recover.

In trading terms, it was enough to knock the stock lower on a big year. In business terms, this looks like an embarrassing glitch, not a structural crack.

Merchants care about two things: uptime when it counts and sales growth over the season.

If the rest of the holidays run smoothly and GMV numbers hold up, this becomes more “remember that one stressful Monday?” than a thesis changer.

Amazon (NASDAQ: AMZN)

The House Always Wins Cyber Monday

Global online shoppers rang up about $17.3 billion on Cyber Monday, with total holiday-weekend e-commerce still growing mid-single digits year over year.

You don’t need a spreadsheet to know who’s licking their chops.

For Amazon, this isn’t just about stuffing more boxes into trucks.

Strong holiday volume helps leverage all the money they’ve poured into logistics, advertising, and AI-powered recommendation engines.

Even with the stock already having a solid year, a clean holiday season with healthy spending and no major fulfillment drama keeps the “steady compounder” narrative intact.

Traders may watch how the stock reacts as actual holiday metrics trickle out; long-term holders mostly want quiet competence and more Prime renewals.

Limited Window (Sponsored)

Many investors are seeing solid gains in today’s market, but solid gains often hide opportunities with far greater potential.

A new analysis highlights the 5 Stocks Set to Double, selected from thousands of companies showing early signs of powerful growth.

These picks feature strong fundamentals and technical indicators that often appear before meaningful upside.

Past editions of this research uncovered gains of +175%, +498%, and +673%.

Download the 5 Stocks Set to Double. Free Today.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

The Data Kid That Just Posted Grown-Up Numbers

MongoDB (NASDAQ: MDB)

MongoDB just reminded the market that boring-sounding software can still throw a party.

Revenue for the latest quarter grew about 19% year over year and came in comfortably ahead of expectations, with adjusted earnings per share landing well above what the Street had penciled in.

Guidance for both the current quarter and the full year stepped higher, and the stock answered with a big after-hours pop.

This wasn’t one fluky deal or a lucky cost cut. Management pointed to strong large-enterprise demand and a self-serve business that’s humming as developers and AI-native companies keep building on the platform.

In plain English: more teams are standardizing on this database as their default, and they’re actually using it more, not less.

What’s Working

Enterprise accounts are scaling up, not just signing once and ghosting.

Self-serve customers—startups, digital natives, AI builders—are turning into a nice tailwind rather than a distraction.

The company felt confident enough to raise full-year guidance by a meaningful chunk, which markets love a lot more than cautious mumbling.

Why The Market Cares

In an AI-obsessed world, you still need somewhere sane to put the data, query it quickly, and not light your infrastructure budget on fire.

MongoDB sits right in that lane: flexible, cloud-friendly, and familiar to the developer crowd that actually decides which tools get used day-to-day.

Add in a fresh CEO baton pass that didn’t derail execution, and you get a name that checks a lot of boxes: real growth, clear product-market fit, and a story that plugs nicely into the “AI and modern apps need better data infrastructure” theme without having to pretend it’s a model company.

What Could Trip It Up

The valuation isn’t exactly sleepy; any hint of slower growth can sting fast.

It’s still not a purely profits-first machine on a GAAP basis, which means investors have to keep believing in the growth runway.

Competition in databases is brutal, with hyperscalers and open-source options always trying to poach workloads.

What To Watch Next

Whether new AI-heavy customers keep signing up and, more importantly, expanding their usage.

How much of that raised guidance comes from durable consumption versus one-off bursts.

Any signs of slower spend from big enterprises if macro jitters show up again in 2026 budgets.

Actionable Take

Builders: This may sit in the “selective growth” bucket. If you’re comfortable with volatility and long-term upside tied to modern app and AI build-outs, scaling in on red days over the next few quarters could make sense. Just size it like a spicy side dish, not the whole portfolio.

Traders: After a big post-earnings move, you’re basically surfing sentiment. Pullbacks toward pre-earnings levels might offer quick entries if the broader growth trade holds up, while any blow-off spike on AI hype could be a place to trim or fade.

Bottom Line:

MongoDB just showed that databases don’t have to be dull.

With solid growth, a confident raise, and strong signals from both big customers and scrappy builders, it’s acting like a real infrastructure winner in the new software stack.

If it can keep that momentum going without tripping over competition or its own valuation, this “background” name may keep stealing more of the spotlight.

Everything Else

🍏 Apple is quietly building out its AI ambitions, teasing new on-device features and a more personal approach that could finally give Siri the IQ boost it’s been promising since 2011.

🏢 Meta’s latest return-to-office push is hitting Instagram staff, with execs reminding remote holdouts that hybrid work doesn’t mean dial in forever.

💼 OpenAI just landed fresh backing from Thrive Holdings to scale its enterprise AI tools, proving that big companies are still happy to rent their thinking caps from the same lab that started the chatbot craze.

📱 Samsung’s first multi-folding phone is here, promising origami-level flexibility and another reason to upgrade if your current screen only bends once.

💾 Nvidia just poured $2 billion into Synopsys, betting that smarter chip design software will help it stay one step ahead in the AI hardware arms race.

That's our coverage for today; thanks for reading! Reply to this email with feedback or any tech stocks you want me to check out.

Best Regards,

—Noah Zelvis

Tech Stock Insider