- Tech Stock Insider

- Posts

- This Beaten-Down Industrial Tech Still Runs the Backbone of Global Commerce

This Beaten-Down Industrial Tech Still Runs the Backbone of Global Commerce

Every cycle has a phase where the market confuses temporary slowdown with permanent damage.

This company looks like one of those cases.

The stock is down sharply from its highs, sentiment is cautious, and headlines focus on inventory digestion and macro noise.

Meanwhile, they keeps selling tools that global commerce quietly depends on to function.

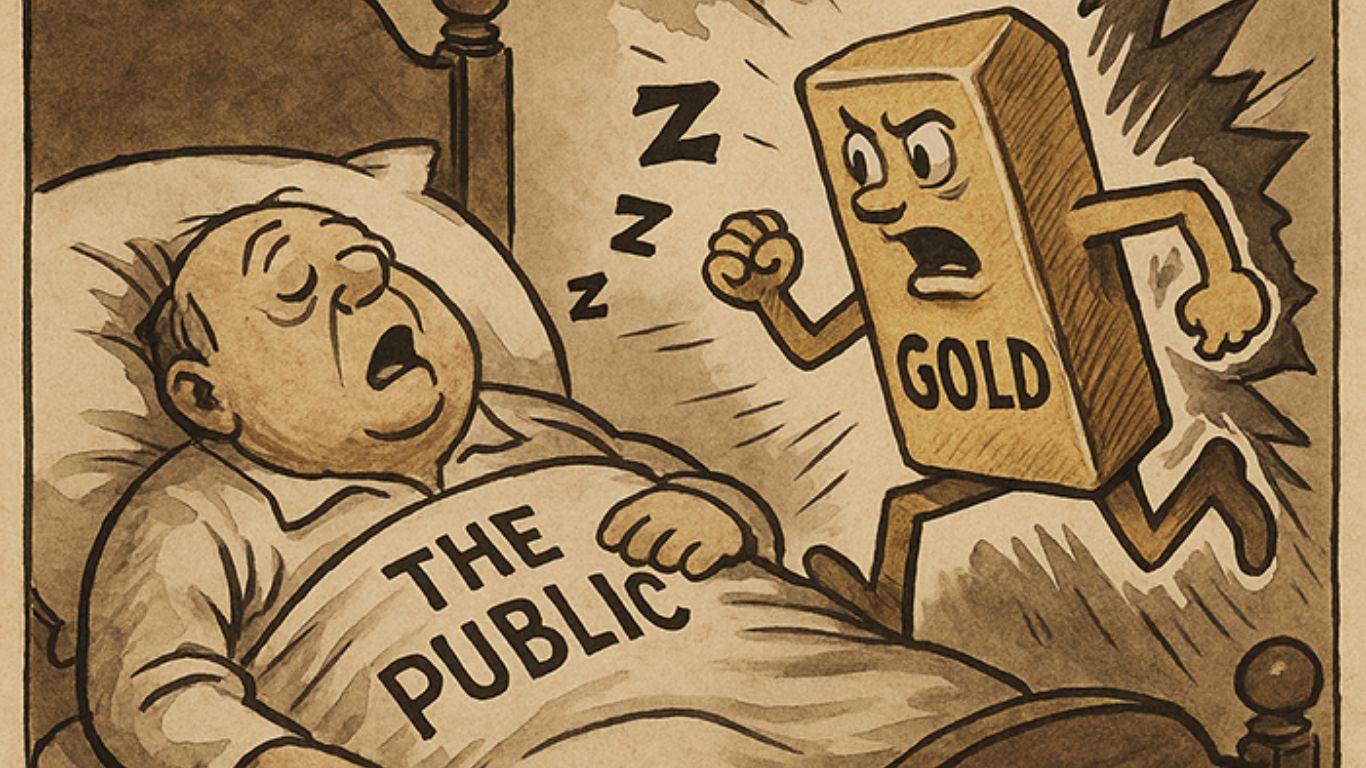

Gold Standard (Sponsored)

Warren Buffett is holding a record $325 billion in cash — not by choice, but because traditional value has vanished.

With government spending surging and inflation quietly eroding purchasing power, sitting still is no longer neutral.

That’s why attention is shifting toward a sector most investors have ignored for years.

Certain gold producers are generating real cash flow, trading at steep discounts, and benefiting from renewed domestic mining support.

One major miner stands out as exceptionally well-run, deeply undervalued, and positioned for the next phase of capital rotation.

The full breakdown — including four smaller miners — is available now.

What Just Happened

Zebra Technologies Corp (NASDAQ: ZBRA) shares have been hit hard over the past year, falling more than 35 percent from peak levels. The decline has far outpaced the broader market and even many industrial tech peers.

The catalyst was not a collapse in demand. It was a normalization. After years of pandemic-era overordering, customers slowed purchases to work through inventory. Guidance softened, multiples compressed, and the stock absorbed the blow.

That repricing is now the setup.

Never Miss Our Top Tech Recommendations Again!

We now send our tech picks via text, too, so you’ll get the same tech breakout news without having to open your inbox.

The Business You Don’t Notice Until It Breaks

Zebra is not a consumer brand. It lives on warehouse floors, hospital corridors, factory lines, and retail backrooms. The company sells barcode scanners, RFID systems, mobile computers, printers, and workflow software that let enterprises see what they have, where it is, and who is touching it.

If you have ever received a package on time, scanned into a hospital, or seen inventory move smoothly through a store, there is a decent chance Zebra hardware was involved.

That is why switching costs are real. Once installed, these systems are not casually replaced.

Accelerated Gains (Sponsored)

$1,000 in just seven stocks in 2004 could have turned into a million-dollar portfolio today…

Back then… one financial expert begged people to look at Nvidia -- when it was trading at just $1.10!

Now… he’s urging you to look at a new group of seven stocks…

Check this Out (The NEXT Magnificent Seven)

Poll: Which feels more stressful to manage? |

Why The Stock Fell Faster Than The Fundamentals

Zebra is cyclical, but it is not fragile.

When customers pause orders, revenue slows quickly because hardware spending is lumpy. The market tends to extrapolate that slowdown indefinitely. Historically, that has been a mistake.

The underlying drivers are still intact:

Global supply chains remain complex

Labor shortages push automation forward

Asset tracking is moving from nice-to-have to mandatory

None of those trends reversed. They just stopped accelerating for a few quarters.

Asset Rotation (Sponsored)

Political transitions historically increase uncertainty—and this cycle is no exception.

Tariff expansion is reviving crash-risk conversations across Wall Street.

Asset protection strategies are gaining attention as volatility accelerates.

Ignoring structural risk has consequences during regime shifts.

Awareness precedes action.

No guarantees are implied.

This content is not a recommendation to buy or sell.

Download the FREE Presidential Transition Guide now.

What’s Quietly Improving Under The Hood

Despite the stock pressure, several things are moving in the right direction.

RFID adoption is accelerating

The Asset Intelligence and Tracking segment continues to benefit from broader RFID use across retail and logistics. That is a higher-value, stickier part of the portfolio.Self-service is expanding

The acquisition of Elo Touch Solutions pushes Zebra deeper into self-checkout and customer-facing automation, a natural extension of its enterprise footprint.AI is creeping in, not hyped

Zebra is not selling splashy AI demos. It is embedding intelligence into workflows, analytics, and machine vision. That tends to monetize slowly, but persistently.Buybacks signal confidence

Management has committed meaningful capital to share repurchases. Companies do not do that if they think demand is structurally broken.

The Cash Flow Angle Matters Here

This is where the story gets less emotional and more concrete.

Zebra generates solid free cash flow. Margins remain healthy. The business funds its own growth, acquisitions, and buybacks without leaning on financial engineering.

That matters because it allows patience. The company does not need a macro rescue to survive. It just needs demand to normalize.

Why This Is Not A Pure Hardware Story Anymore

Calling Zebra a hardware company misses the direction of travel.

The hardware creates the footprint. Software, analytics, and services deepen the relationship. Over time, the revenue mix shifts toward higher-margin, recurring streams tied to installed systems.

That is why customers do not rip this stuff out when budgets tighten. They delay expansion, not replacement.

What Needs To Go Right From Here

The path forward is not complicated, but it is not instant.

Inventory digestion needs to finish

Organic growth needs to stabilize in the mid-single digits

RFID and machine vision need to keep compounding quietly

Capital returns need to stay disciplined

If those boxes get checked, the stock does not need heroic assumptions to re-rate.

How I’d Frame A Position

This is not a chase. It is a wait-and-build.

Starter exposure makes sense for investors who want leverage to automation and supply-chain digitization without paying peak multiples. Adding on confirmation is reasonable once revenue trends turn.

This is not a momentum trade. It is a mean-reversion plus durability play.

The Bigger Picture

Zebra sits in a rare category. It sells unglamorous products that become more essential as the world gets more complex. That makes it cyclical in the short term and resilient in the long term.

The market is currently focused on what slowed. Less attention is paid to what never left.

That gap between perception and usage is where opportunities tend to form.

Bottom Line

Zebra Technologies is paying the price for a post-boom reset, not a broken business. The stock reflects caution. The operations reflect continuity.

If automation, tracking, and visibility keep expanding across global commerce, Zebra remains part of the plumbing. And plumbing rarely gets replaced. It just gets upgraded.

At these levels, the stock does not need perfection. It just needs normalization.

That's our coverage for today; thanks for reading! Reply to this email with feedback or any tech stocks you want me to check out.

Best Regards,

—Noah Zelvis

Tech Stock Insider